One Time Death Benefit - Email, link or fax social security ssa 8 form. You can also download, export or print.

Is the perfect editor for updating your documents online. Follow these simple instructions to update your social security benefits online for free in PDF format.

One Time Death Benefit

We have more options for Social Security Death Benefit forms. Choose the correct version of your Social Security Death Benefit form from the list and start editing right away!

Whole Life Insurance For Doctors

We will provide answers to our customers' most common questions. If you cannot find the answer to your question, please contact us.

You can apply for benefits by calling our state toll-free number at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. Appointments are not required, but if you call for an appointment, it may take a while to get your application back.

If, however, it is an inheritance, the executor of the will named or by the hand of the executor with the authority of the judge to dispose of the inheritance will have the place to the death of the beneficiaries. The executor must apply for benefits within 60 days of death.

If the spouse or child in the register of the deceased was receiving family benefits, the death benefit is paid automatically after the death is reported to the social security. if not, the survivor must claim the death benefit within two years of the death.

Complete Set (2) Robin Cook Medical Books Pia Grazdani Series Nano Death Benefit

Widows or widowers, 60 or older, but under full retirement age, receive 71-99% of the basic employee benefits. A widow or widower of any age with children under the age of 16 receives 75 percent of workers' compensation benefits. 75 percent of children receive employee benefits.

Applying for the bereaved benefits In most cases, funeral homes inform us of people's deaths. If you want to file a death report, you must provide your social security number to the funeral home. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778).

How can I apply for $255 in social security death benefits online social security death benefits for children eligible for mass social security death benefits? How to Apply for Infant Death Benefits How long does it take to receive a Social Security death benefit of $255 for a spouse's death benefit?

This form must be submitted with multiple returns. IF YOUR E-FILE NM PIT-I, PIT-CX..

Death Benefit Archives

Death benefits can be paid as a lump sum or as monthly or annual annuities. Lump sum payments are not taxed, but annual payments are. To apply for a death sale loan, you will need a copy of the death certificate, life insurance policy information and a claim form.

Parents aged 62 and over who received at least half of the support from the deceased can receive benefits. A one-time payment of $255 can only be made to a spouse or child if certain qualifications are met. Survivors must apply for this payment within two years of death.

A one-time payment of only $255 is possible if a spouse or child meets certain requirements. Widows or widowers are eligible for benefits: Age 60 or older. If wrong, age 50 or older. Children of the deceased under 16 years of age or with disability will be cared for at any age.

This site uses cookies to improve navigation and personalize your experience. By using this site, you consent to our use of cookies as described in our UPDATED Privacy Statement. You can change your preferences by visiting our Cookies and Advertising Policy. Variable life insurance products allow a portion of your premiums to be deposited into the insurance company's fund, allowing your beneficiaries to increase their tax-free benefits if they grow.

Whole Life Insurance Cash Value Chart [3 Examples]

Various universal life insurance products offer the same investment opportunities with some additional features. This whole life policy allows you to invest your cash value and provides you with flexible premiums and flexible death benefits.

In a variable life insurance policy, the maximum premiums are invested in one or more accounts, with a variety of investment options to choose from. You can choose from fixed income, stocks, mutual funds, bonds and mutual funds. In addition, the interest rate increases with the ratio of the account. Risk tolerance and investment objectives determine the amount of risk.

Typically, insurers have professional investment managers who oversee the funds. As a result, you will be charged an administration fee. Therefore, the overall investment performance is a place of greater interest.

Variable universal life insurance (VUL), as the name suggests, is a plan that combines variable and universal life insurance (that is, flexible variable life insurance). This is one of the most popular insurance portals that allows you to locate and easily change your insurance coverage.

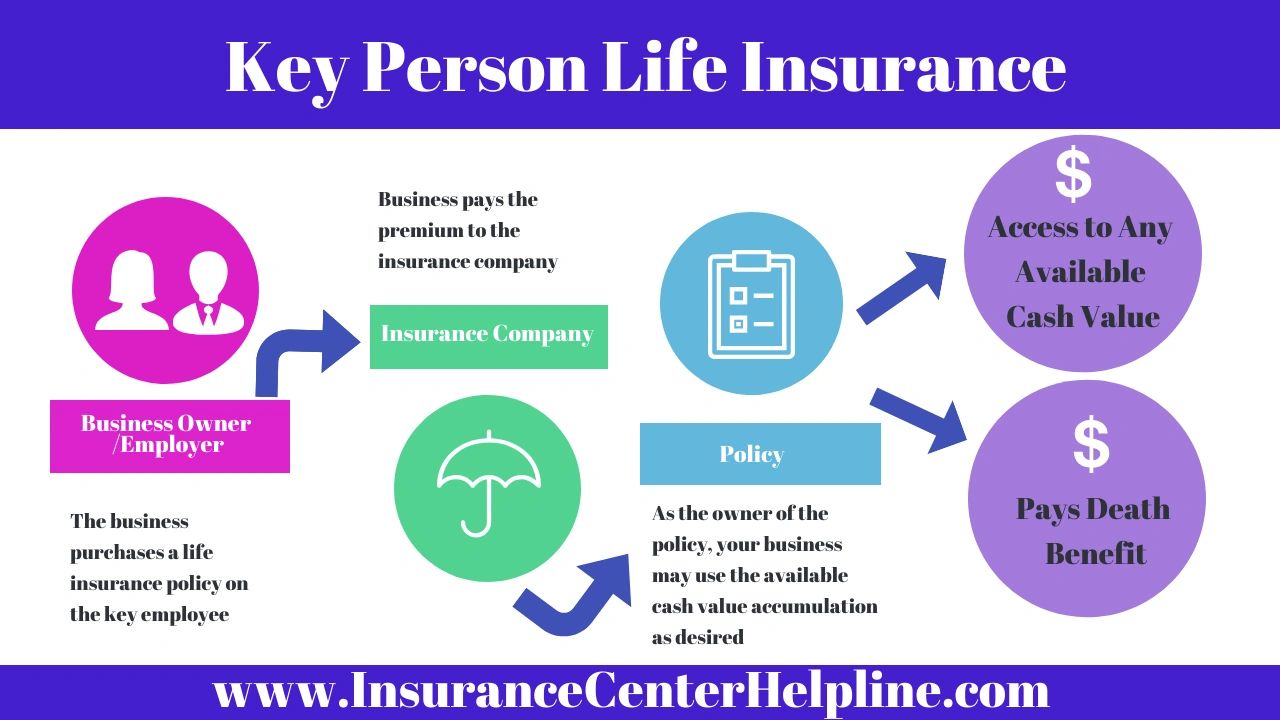

Key Person Life Insurance

As with universal life insurance, you can decide the amount and frequency of premium payments within certain limits. You can also make a one-time payment up to a certain term or use your savings to pay the premiums.

Since the two life insurance policies are so similar, it can be difficult to choose which one is right for you. The key to both products is their variable death benefit, which attracts those who believe the market will deliver successful results. To answer these questions, choose between the two.

It is important to note that both of these policies require you to bear the risk of investing in your life insurance. Depending on market conditions, your beneficiaries may receive more or less.

A variable life insurance policy allows you to invest in your life insurance plan. If the markets cooperate, the potential for death benefit is increased, but if they do not, the benefit can be significantly reduced.

Va Benefits For Veterans' Surviving Spouse, Children And Widows

Variable life insurance allows you to choose how to invest in your life insurance, allowing you to maximize the cash value of your plan.

Variable life insurance comes with the inherent risk of investing in a fund. You are free to choose the products you want, but if they don't work, your income, and therefore your profits, can drop significantly.

Your life insurance needs can change over time, and different life insurance products can best accommodate these potential changes. That's why variable life and CPD plans can hedge against inflation if you double inflation.

For some, managing multiple life investments provides a welcome convenience, while others prefer greater flexibility.

Here's What Happens To Social Security Payments When You Die

By clicking "Accept All Cookies", you consent to the storage of cookies by your policy to improve site navigation, site usage analysis, and assist marketing efforts. Life insurance is a type of death insurance. benefits are paid periodically to the heirs of the policyholder.

After the term has expired, the policy can be extended to another term, the policy can be converted into permanent insurance or the term life insurance can be canceled.

When you buy term life insurance, the insurance company determines the premium based on the value of the policy (promise) and your age, gender, and health.

In some cases, a medical examination may be necessary. The insurance company may ask about your driving record, current medication, smoking status, occupation, hobbies and family history.

Understanding Social Security Benefits

If you die during the term of the policy, the insurer will return the face value of the policy to your beneficiaries. In most cases, this cash benefit, which is taxable, can be used by the beneficiary to pay off your medical and funeral expenses, utility bills, and mortgage debt.

If the policy expires before your death, no payment will be made. You can renew the policy after the expiry date, but the premium will be calculated based on your age at the time of renewal.

A term life policy has no value other than the death benefit. There is no savings component like that found in whole life insurance products.

Term life insurance is usually the least expensive life insurance because it provides benefits for a fixed period of time and only provides a death benefit. For example, a healthy 35-year-old smoker cannot buy whole life insurance with $500,000 in benefits averaging $28 per month through 2021. At age 50, premiums increase to $71 a month.

Form Ssa 8: Fill Out & Sign Online

Depending on the issue, a lifetime purchase can pay the equivalent of $200 to $300 a month or more in premiums.

Most of the life term ends at the beginning without the cost of the death benefit. This reduces the overall risk compared to a regular life plan. With reduced risk, insurers can charge lower premiums.

Interest rates, the financial condition of the insurance company, and government regulations can all affect premiums. In general, companies often offer better rates at "breakage" coverage levels of $100,000, $250,000, $500,000, and $1,000.

Death benefit insurance, death benefit for veterans, workers comp death benefit, accidental death benefit insurance, graded death benefit, term insurance death benefit, death benefit insurance policy, fixed annuity death benefit, accidental death benefit, death benefit life insurance, government death benefit, death benefit policy

0 Comments